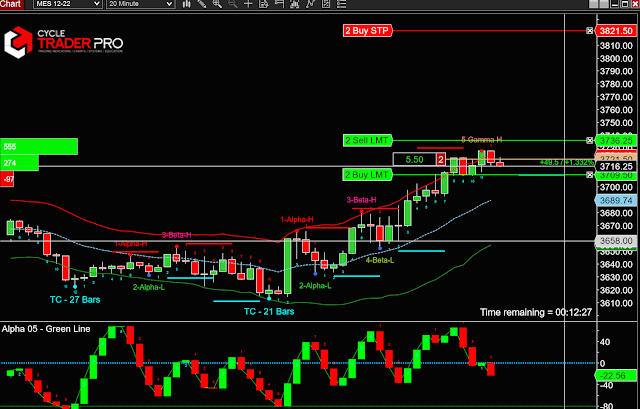

2nd Fill Level

Our Cycle Trader Pro trade models all suggest not to go all in on anyone trade entry. We found it is vital to scale into and out of trades because no one knows for sure where the market is going to be in 15 minutes from now. The models suggest to always reach for your first entry price which is a key component to your exit price. The 2nd model is your 2nd entry and how to price this level in using the Prophet Target moves and again reaching X points above or below these moves. Once you get your 2nd fill Price Advantage filled order, this would create a 50% better 1st entry price level. We trade the same QTY for 1st and 2nd entries. You can change this around and the percentages will change with the different QTY submitted if filled each time. But, we like to keep it simple and using the same QTY on each order is simpler to figure out. https://cycletraderpro.com