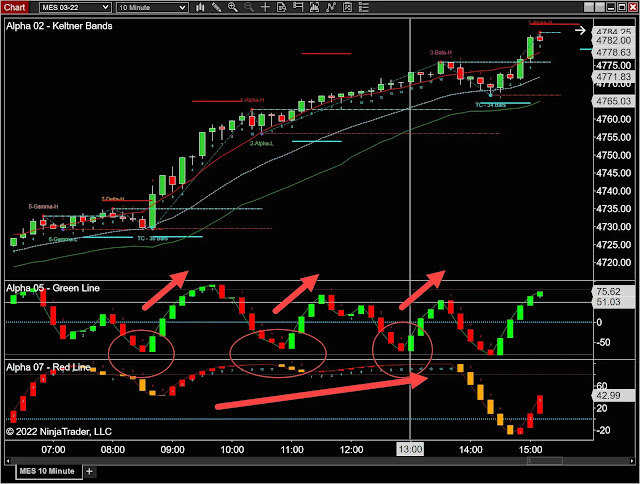

Meat and Potatoes

The Meat and Potatoes of the market is where you see where most of the OPENS and CLOSES from the following past trades. We propose this is both support or resistance areas to enter or exit trades. Meaning, if you are above the Meat and Potatoes, then this would offer support below the market and if below Meat and Potatoes, then this would suggest resistance above the market. This model is also where the market is likely to come back to. It can also be a C-zone where the market is going sideways. Think about this idea, if the the market is trending down, and we recognize Meat and Potatoes below and to the left of the chart, we will suggest the market may come back to that range. This can help you decide to place long orders in this range rather than the top of the current bar. Another scenario - If the market holds above or below Meat and Potatoes - If the market drop below or above Meat Potatoes and holds, then this would suggest prices are being accepted and price action could co

.jpg)