Fade The Swings

Fade The Swing model happens more times than not.

Have you notice that the market creates a swing high/low and then on the next move in that direction it does all it can to take them out and then bounce out of there?

This is how the floor traders would trade and still do if there was a floor. Think about this, there is a swing low developed and all the retail traders were taught to put stops there. This would be they were trying to buy the market with sell stops at the swing low.

Here, the floor traders are selling hard into this level, meaning they are short into the move.

If there are sell stops there, the opposite side of the trade is a long buy order,

Go back to the floor traders being short, they need to buy to exit.

Go back to the see stops above, this is the perfect set up for the floor traders. Lots of stop order to sell to exit which means lots of buy order to buy those sells stops.

The take out the swings also sets up the following models -

- Divergent Lows

- Stab Buy/Sells

- Double Bottom/Tops

- Extended 4 to 9 Bar Cycles

- Fail the Moving Averages

There are more, but you get the idea of many reversal models happening at the same time.

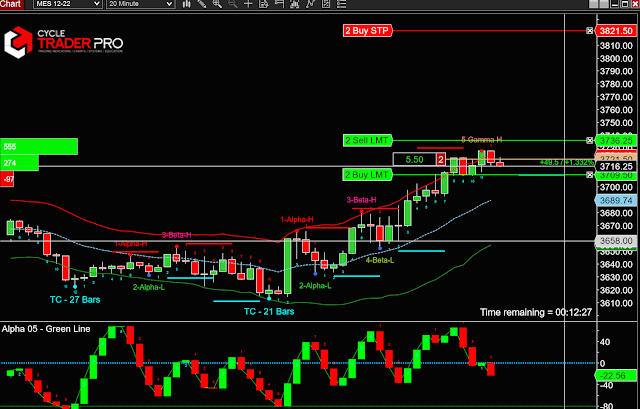

How do you trade Fade The Swing?

We suggest that you reach for a fill level price using Price "Fill" Advantage type orders, then implement the 2nd fill model and use Price Advantage models.

There will be times that the market will continue, so keep this in mind and that is why we always suggest to enter as we mention above.

Comments

Post a Comment