4 to 9 Bar Cycle Count

4 to 9 Bar Cycle Count -

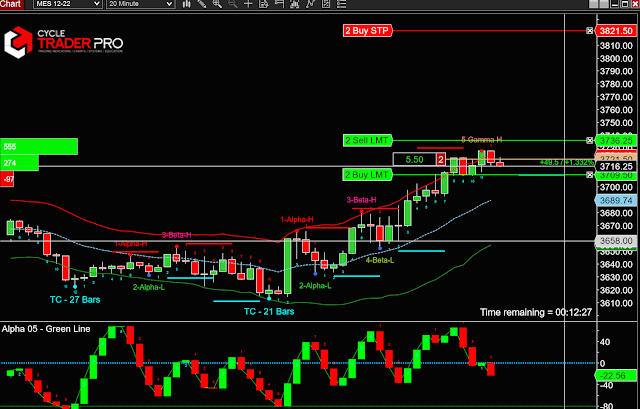

Most markets follow the 4 to 9 Bar Cycle Count from low to high and high to low.

The cycle count is accurate for all markets and all time frames.

Meaning, it does not matter if you are trading pork bellies, currencies, indexes, or bonds; the cycle count is valid in all markets and all time frames, 1,4,6,10, 15, 40, 60, 120, etc minute charts.

The Alpha CycleWave indicator plots these cycle counts in real-time.

The setup is to wait for the market to reach a cycle bottom or top and exit positions. This gives you the "timing" to look for when markets are likely to turn.

There are what we call "extended cycles". This is when the market will go past the 9 bar cycle count. You can look for these extended cycle counts in trending markets.

We suggest to look at all time frames. Meaning, if the 60 minute chart is only 3 bars up, and the 5 minute chart is making a 7 to 9 bar cycle high, it may be best to wait for the 5 minute bottom to go long rather than try to sell the short term cycle high.

Many times on short term charts, they may enter into what we call a C-Zone pattern. The C-Zone patterns means the market will congest into a sideways movement rather than a correction.

Opposite closes - During a 4 to 9 bar cycle move, you will almost always see opposite closes along the way. These closes do not mean the move is over. Try not to get caught into these traps. Understand that these opposite closes happen.

Comments

Post a Comment