FAIL Trading Model Against the Moving Average

A FAIL is when the market moves above or below the 15 moving average and FAILS back the other way -

A FAIL usually takes place within 1 to 3 bars.

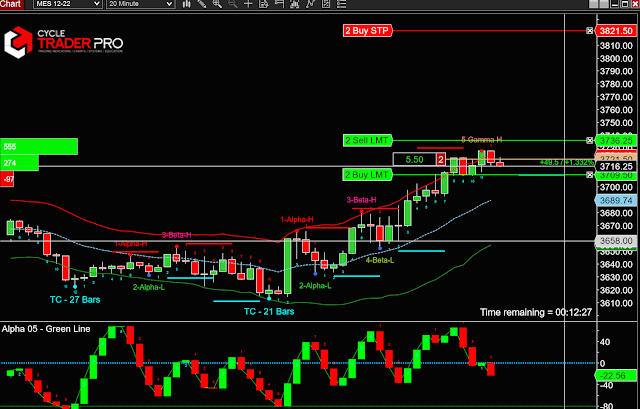

The reason for the FAIL model was to identify the pattern the market was in at the time and understand that market can go past the moving averages and FAIL back to the original trend. Meaning, just because the market may have dropped below the moving average, it may not mean the upper trend has stopped.

Note: All Trading Cycle (TC) Lows do happen below the 15 length moving averages and a drop below the moving average is expected. When the TC Low is confirmed, one would expect a 4 to 9 bar cycle period up from the TC Low.

Comments

Post a Comment