It Takes Patience

The Futures markets are highly leveraged, and a small percentage move in the market can be a large percentage move in a trading account.

There are 2 types of traders:

1. The microwave trader - a trader that is in and out as quickly as possible. This type of trader can do okay trading and have a wonderful life.

2. The patient traders - a trader that can ride out the storms of the ups and downs. This type of trader will have much larger swings in his account and, if correct on the trend, will most likely make a killing if correct, and they stay in for the big moves.

Each trader has to decide to trade, act on your trade models, never look back. Try to Go Fish and get reasonable fill prices, scale into trades, and out of trades. Take your ball and go home.

Have patience can also work for the microwave type trader -

There will be new position entry points that just do not turn or continue at the speed you might have hoped for. If you are fading a cycle high/low model for example. The market may turn, but then create a double top/bottom formation which takes time. This is perfectly fine, they happen.

You just need to apply patience and if the trend is to continue in your direction, then it will all work out. Many times, it won't be pretty. It will be a mess. Meaning the markets will try to make it hurt.

How to allow the market to move around without feeling you are not in control?

My ONLY answer is the Take Your Half's Off model. It is important to take off positions, lock in profits and reduce exposure all at the same time. With the Take Your Half's Off model, you are in control, relaxed, and a real-trader.

Scale into trades -

The Take Your Half's Off model works best once you accumulate positions. We do not suggest starting with max contracts on the first entry-level. We recommend scaling into trades and out of trades.

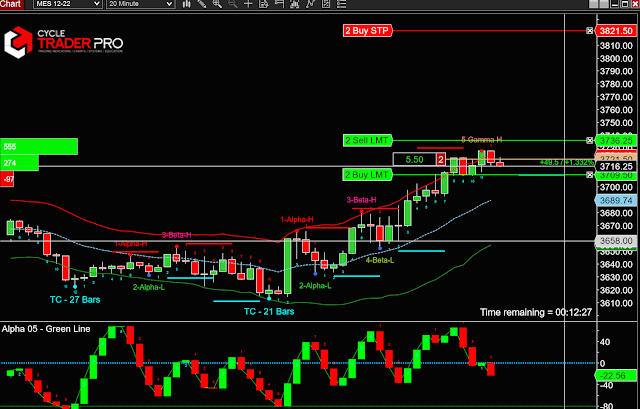

For example, start with 2 contracts, add 4, add 2, add, 2,2,2, now you have 14 contracts at x better average price. This alone is applying patience to the cycle turn model. Allowing the market to accumulate positions. Now the market moves in your direction and you take 7 off at 2 to 3 point profit (ES), NOW, you can relax. There are 2 choices now, put a stop at true average entry-level or 2 to 3 points above average entry for a Break-Even trade at worst.

What will happen now if I wanted to stay in the trade for the big move?

This is where the real pro comes into play. If you nailed a nice trend and the long-term cycles have room to go, there will be lots of ups and down moves along the way. You will see lots of $ money going up and down as the market makes its move. It will not always seem right, but on strong trending days, in the end, there may be a great payday for you.

Keep in mind your protective stops and risk.

Can I add contacts and sell half's as the market trending?

Yes, we suggest this model. If you nailed the trend, have protective stops in place and you want to start to buy and sell contracts above your true average entry price, there is the opportunity. What we say about this is we have what we call a CORE POSITION in place and then the extra entry and exits are just that. Fast trades, but hold the core position.

Comments

Post a Comment