Stab Buy / Sell model

Stab Buy / Sell model -

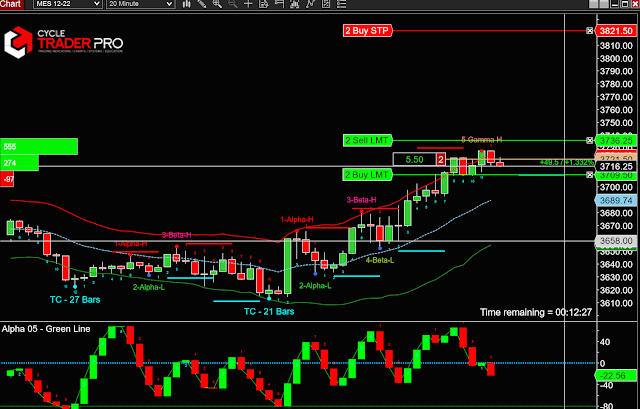

This model is when price levels exceeds a 1.5 or more deviation from the 15 / 20 Moving Average -

What happens when the price level extends?

The market price typically moves back to at least the upper or lower Keltner bands.

For example, if the 1.5 deviation is at 4150 and the market drops to 4142, this would set up a Stab Buy. In this case, one would expect the market to at least move back to the 4150 range.

Note: The bands will move on each new bar. Keep this in mind if the market price holds up or down. On the next bar, the formula of coming back to the band's still works, it's just the bands are also moving with the market on each new bar.

The more significant the deviation move, the higher likelihood the trade will work out. There is no 100% trade, but this one is up there.

Note: This type of trade is also considered the riskiest trade model on our list, which means that sometimes, the market may not come back to the bands for a while and hold its ground, making it difficult to exit the market with a profit when this pattern develops.

We suggest to reach for fill price levels (Go Fish) to start any trade off with and the scale into trades and out of trades to try to lock in profits.

Comments

Post a Comment